Convenience, But at a Cost

Accepting credit cards has become a necessity for businesses of all sizes. Customers enjoy the convenience of paying with a card and many consumers even expect to earn points or cash back each time they swipe or tap. That convenience comes at a price for businesses. Each card payment triggers a network of banks and payment processors that must all be paid for their role in moving money. While a typical business owner may only see a monthly processing fee deducted from their deposits the reality is far more complex. This article explains why those fees add up and why credit card processing can be so expensive.

The Players in a Card Transaction

A credit card payment involves at least four parties:

- the cardholder’s bank (often called the issuing bank),

- the business’ processor (the acquirer),

- the bank that backs the processor (acquiring bank)

- and the card network that connects them (Visa, Mastercard, etc).

When a customer pays with a card the customer’s card issuing bank pays the processor’s bank which then pays the business that made the sale. The issuing bank then collects repayment from the cardholder at the end of the billing period. The processing fees that the business pays compensate the banks and networks for the transaction processing and risk they carrry for paying the business before the money is actually collected from the customer.

The Anatomy of Processing Costs

Processing costs are usually divided into three categories:

- Interchange fees: These are paid directly to the issuing bank. They are the largest part of processing costs and are non negotiable because the networks set them.

- Assessment fees: These go to the card networks such as Visa, Mastercard, American Express, or Discover.

- Processor markup: This is the margin that your payment processor or merchant service provider adds on top for providing access and support.

Why Interchange Fees Are High

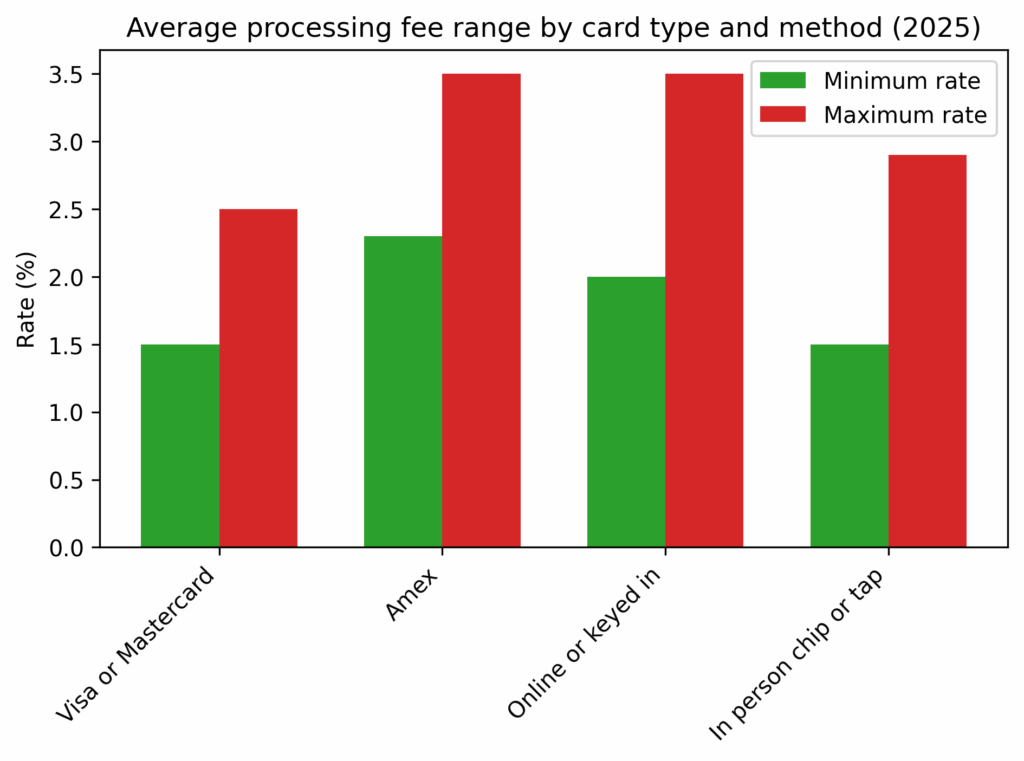

Interchange fees are the bulk of costs and can range between 1.3% to more than 3% per transaction depending on card type and how it is accepted. Premium rewards cards, for example, carry higher fees because the bank must fund travel points or cash back for the customer. Similarly card not present transactions, such as online sales, are seen as riskier and are assigned higher rates. This fee structure ensures that the issuing bank is compensated for the risk of fraud non payment and rewards programs.

Assessment Fees Add Up

Card networks charge assessment fees to cover their role in maintaining global payment systems. Though, smaller than interchange they add up across millions of transactions. Visa and Mastercard may charge only a fraction of a percent but because every single card sale pays this fee it can become significant portion of a business’ long-term costs.

Processor Markup and Contract Complexity

The processor markup is the only negotiable part of the cost. Unfortunately, many processors layer fees in confusing ways. They may charge “tiered pricing” plans where transactions are bucketed into different rate tiers without clear explanation. Flat rate providers simplify this by charging a single fee for all transactions, but that rate usually includes a healthy margin. The lowest way to incur processing fees is called “Interchange-plus” but it is also the most complex looking on statements because it shows the actual network rate for each transaction plus your processor’s markup.

Business owners that do not take the time to understand the various rate plans and closely analyze their statements often pay more than necessary.

Hidden Costs Beyond the Swipe

Beyond the headline percentages many businesses encounter other, often negotiable, charges:

- Monthly statement or account fees

- PCI compliance fees for meeting security standards

- Batch fees for closing out daily sales

- Chargeback fees when a customer disputes a transaction

- Early termination penalties if you end a contract before the agreed term

Credit Card Rewards and the Cost of Interchange

One of the biggest but least visible drivers of interchange fees is the rewards programs that many consumers love. Points, cash back, and airline miles all have to be paid for by someone, and that “someone” is largely the business through higher interchange rates. When a cardholder swipes a premium rewards card, the issuing bank passes along a larger fee to the business’ processor. That money helps fund the bank’s payouts for free flights, hotel stays, or statement credits.

In effect, businesses subsidize consumer perks. A store that accepts rewards cards is not just paying for the convenience of accepting plastic, it is also covering the cost of a customer’s vacation points or cash back. While this system makes cards more attractive to consumers, it adds to the rising expense for businesses. Since interchange fees are set by the card networks and are non-negotiable, businesses have no choice but to bear these extra costs. Over time, this cycle pushes average processing costs higher, especially in industries where customers prefer premium cards with generous rewards structures.

Fraud Prevention and Risk Management

One major driver of cost is fraud prevention. Card networks and banks invest heavily in encryption, tokenization, and fraud detection systems. These investments are funded by the fees that businesses pay. Online fraud in particular continues to rise and the costs of reimbursing customers or managing disputes are reflected in interchange categories.

Technology Costs

Modern processing includes point of sale hardware software integrations reporting tools and customer support. While technology lowers barriers to entry it also requires ongoing updates and security patches. Processors recover these investments through their markups and service fees.

Global Network Maintenance

Card networks operate massive infrastructure capable of authorizing transactions in seconds across the globe. Maintaining these networks is expensive and the cost is distributed through fees on every card swipe tap or click. businesses in effect subsidize global payment convenience through their processing bills.

Market Concentration

Visa and Mastercard dominate the card market in most regions. This concentration gives them immense pricing power. While regulators monitor antitrust concerns the networks still set interchange schedules that all banks and processors must follow. With little competitive pressure downward fees tend to rise slowly over time rather than fall.

How Business Type Affects Cost

Not all businesses pay the same rates. High risk industries such as travel gaming or CBD products face higher interchange and processor markups. These industries are considered more prone to chargebacks and fraud. Even within mainstream retail a business that primarily accepts cards online will face higher costs than a business that swipes cards in person because of the added risk of remote transactions.

International Transactions

Cross border transactions carry additional assessments often 1% or more on top of all of the other fees. Currency conversion also introduces costs. Businesses that sell internationally must account for these surcharges that domestic only businesses do not face.

Why Fees Seem Opaque

Businesses often complain that their processing statements are hard to read. This opacity is not accidental. Complex billing makes it difficult for businesses to identify exactly where money is going. Without transparency many businesses simply accept the cost as a cost of doing business even if savings could be achieved with a different pricing model.

Ways to Reduce Costs

Although interchange fees are non-negotiable, businesses can still take steps to reduce costs:

- Choose the right pricing model such as interchange plus instead of tiered rates

- Work with processors that specialize in transparency and low markups

- Encourage card present transactions whenever possible

- Batch transactions daily to avoid additional fees

- Maintain PCI compliance to prevent penalties

- Audit your statements for unnecessary charges

Future Trends

The cost of processing may change as new technology and regulation emerge. Real time payments cryptocurrency adoption and open banking could provide alternatives to traditional card networks. At the same time networks are likely to defend their market position and maintain fee structures. Businesses should expect gradual changes but not dramatic fee reductions in the near term.

Final Thoughts

Credit card processing costs are expensive because they fund a vast ecosystem of banks networks processors and security measures. From interchange fees that reward issuing banks to assessment fees that keep global networks running every party in the chain takes a share. Add processor markups hidden charges and risk management and the true cost of convenience becomes clear. By understanding the structure of fees, businesses can make informed choices that minimize expenses even if they cannot avoid them entirely.