So You Are Ready to Move Processors: Here’s What to Consider

Deciding to switch your credit card processor is not a trivial decision. You need to know what you are leaving, what you will gain and how the change may affect your costs and daily operations. Businesses often change processors to lower high processing fees, escape poor service, or upgrade hardware. However, a rushed transition can cause downtime, confusion, and unexpected costs. This guide will help you identify what you need to consider before making the switch.

Check For Cancellation Fees

Before moving to a new processor, thoroughly review your existing merchant account agreement. Many contracts include auto renewal clauses or require written cancellation notice within a specific window. Carefully check for any early termination or cancellation fees and note how long the contract term lasts. Checked whether you signed a personal guarantee that could make you personally liable for cancellation fees even if your business is an LLC or corporation. An early termination fee may be a flat dollar amount, a prorated fee that decreases over time, or a liquidated damages clause based on the processor’s estimated lost profits. Flat fees typically range from about $200 to $600, but liquidated damages clauses can total into the thousands and beyond. Knowing these details will help you factor any potential penalty into your decision and you might even be able to negotiate with the new provider to cover part or all of the cost.

Rate Plans and Realistic Quotes

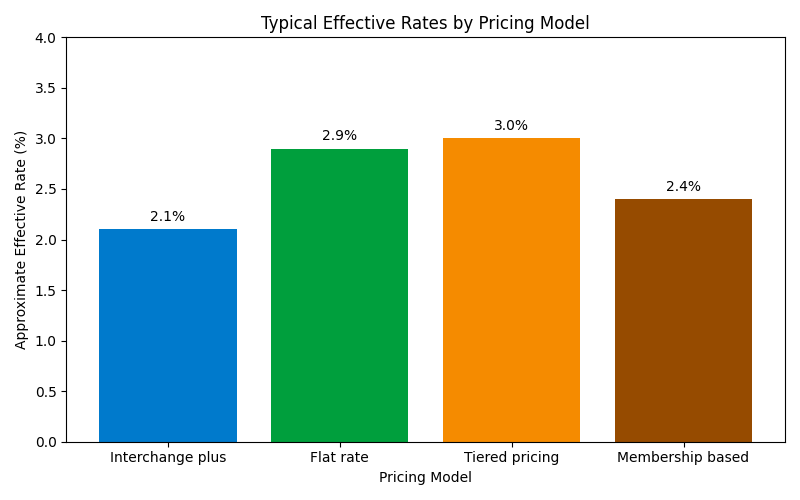

The various rate plans that processors offer will greatly influence your processing costs. Each pricing model has unique advantages and risks. Be sure to clarify which model a quote uses, as comparing quotes that use different rate plans is like comparing apples to oranges.

Common Processing Rate Plans

- Interchange-Plus (or Cost Plus) pricing separates the wholesale interchange and assessment fees as set by the card networks from from your processor’s markup. With interchange-plus, you pay the exact interchange rate set by the card network plus a small fixed markup (for example: interchange + 0.25 % and 10 cents per transaction). This rate plan option is the most transparent because your statement will separate the network fees from the processor’s markup, making it clear how much your processor is making from your processing. Interchange-plus is almost always the most cost effective pricing plan, and the only one that allows you to truely compare one provider’s quote to another.

- Flat Rate pricing charges a single blended percentage plus a fixed per transaction fee for all transactions, regardless of the actual card network cost of the particular card being transacted. This model is the easiest to understand because there are no other fees to consider, making it popular with startups and new businesses. The downside is that it is almost always more expensive than interchange-plus.

- Tiered Pricing extends flat rate pricing in to more than one flat rate. This other tiers are often defined as “qualified,” “mid-qualified,” and “non-qualified” but we are beginning to see more variations of the model with just two tiers. The tiers become progressively more expensive depending on the card type and how it is transacted. Though tiered pricing is falling out of fashion, we still encounter businesses under this rate plan. Generally speaking, the most expensive processing services we help our clients with are under tiered pricing plans. This is because it lacks transparency and they never disclose how they determine their mix of card types for each tier.

- Blended interchange-plus plans are the industry’s attempt to trick business owners by marketing “interchange-plus” rates but in practice still bill under tiered rates. The statements we see under these plans are particularly deceptive because they look very similar to actual interchange-plus statements. The difference is that the rates do not match the actual published networks rates. In fact, on closer inspection of a statement, there is usually only three rates being assessed across all transactions, plus the processors markup as a separate item. This makes it appear that the transactions are being assessed at network rates, but in actuality there there are two markups. One baked into the “interchange” rate and one that is clearly displayed. Often, it takes an expert to determine if a business is under this predatory rate plan.

- Membership Based pricing charges a monthly subscription plus the actual interchange rate with no additional markups beyond the monthly membership fee. On the surface, this rate plan sounds like a great deal; however, we often encounter processors who refuse to provide detailed statements showing the interchange rates that each transaction experience. On several occasions, the business’ effective rate was much higher than it should have been for its industry. This leads us to believe that some providers are baking hidden profit into the processing fees. Such practices can be particularly hard to detect without the proper tools and know-how.

The following chart illustrates typical effective rates for different pricing models. Use it to visualise where your current or proposed rates fall relative to averages.

Will You Need New Hardware?

You will need to verify if your existing hardware such as card readers, terminals and payment capture devices will be compatible with your new processor. Many processors use proprietary devices that cannot be reprogramed to work with other processors. You will also need determine whether you own or lease your current hardware. If you lease or rent, you will likely need to return the equipment or risk getting charged a hefty fee when you cancel. Owning the equipment gives you flexibility to reprogram the device with a new provider, provided they support it. If you want more flexibility to change providers without switching your hardware every time, be sure to work with processors that offer third-party hardware that is processor agnostic.

Important Integrations to Consider

Make sure your payment processor connects smoothly with your current integrations, such as with your accounting services. It is important to understand exactly how the new processor integrates with your current systems because not all integrations cover the same features. Additionally, it is critical to understand ahead of time if the processor will assist with transitioning your integrations and offer on-going support.

Will You Have to Retrain Staff?

Switching payment systems is not just a technical exercise; it also affects the people who will use the new system. Many businesses hesitate to switch because they worry about downtime, retraining staff, and the potential impact on the customer experience if the new system doesn’t perform as expected. Thoroughly vetting a demo of the system with some of your staff can minimize these risks. If possible, run the old and new systems in parallel until you are confident that the new system provides the benefits that you require.

Research Your New Processor’s Reputation

The last thing you want to do is find yourself locked in with processor that failed to disclose important costs or overpromised a level of service they can’t deliver. Too often we see businesses fall into the trap of following features and marketing over research and due diligence. There are a lot providers that will promise you the moon but deliver stinky cheese once you sign the contract. The biggest red flag you can encounter when shopping processors are ones that are pressuring you to move quickly. They might try to motivate you by telling you that rates will be going up the next day or that a quote is only good for a short period of time; these are nothing more than sales tactics aimed at getting you to move quickly. Slow down and thoroughly research any processor you are considering. It could save you not only a massive headache later, but also thousands of dollars.

Conclusion

Switching merchant services can save money and improve the experience for both your business and your customers. But the change takes careful planning. Begin by reviewing your current contract, paying close attention to termination fees and hardware ownership. Learn the different pricing models and request quotes you can actually expect to pay. Check if your equipment and software will work with the new provider, and prepare for any integrations. Train your staff and run tests so your checkout stays smooth. Judge processors by their reputation, pricing transparency, PCI compliance support, and customer service. Once you’re sure the benefits outweigh the costs and risks, build a detailed transition plan, document every promise, and move forward with a modern, efficient payment solution.